The Philippines’ financial ecosystem is changing, highlighted by an increased GCASH monthly limit to ₱500,000. This adjustment greatly benefits users who depend on digital wallets for transactions, investments, and savings. As digital finance grows, understanding these limits is vital for effective navigation of this economic shift.

This article discusses the implications of this increase, user experience enhancement, and how to utilize GCASH’s features for investment and linked accounts, aiming to provide valuable insights for optimizing the GCASH experience.

GCASH Monthly Limit Increased to ₱500,000

The recent policy changes have raised the monthly GCASH limit to ₱500,000, addressing the needs of Filipino consumers and promoting cashless payments, financial literacy, and accessibility to banking services.

As mobile transactions rise, grasping the effects of this limit on everyday activities, like bill payments and mutual fund investments, is essential.

Enhancing User Experience

A primary benefit of the higher limit is improved user experience. Users can conduct larger transactions without splitting payments, aligning with the trend toward convenience in financial dealings.

This limit also encourages cashless transactions, offering a safer alternative to cash handling, particularly in urban areas prone to theft.

Creating Investment Opportunities

The increased limit allows users to invest more significantly. Through GCASH’s GInvest feature, individuals can explore various investment vehicles such as mutual funds.

This flexibility enables users to capitalize on market fluctuations and build wealth over time, contributing to financial independence for many Filipinos.

Promoting Financial Literacy

Higher transaction limits foster greater financial literacy. With better access to funds, users learn budgeting, saving, and investing.

GCASH provides educational resources to empower informed financial decisions, positively impacting the community’s overall economic well-being.

Digital Payments Evolution in the Philippines

The growth of digital payments indicates a major shift in consumer behavior, with increased adoption of e-wallets and online banking.

Factors Driving Adoption

User convenience brought by smartphone access has made financial management easier. Additionally, the COVID-19 pandemic accelerated the move toward cashless payment options for safety concerns.

Government Initiatives Supporting Cashless Transactions

Challenges and Considerations

Despite the benefits of increased GCASH limits, security remains a concern. Protecting user data and preventing fraud are top priorities. Users must practice safe online habits.

Another challenge is the digital divide in some regions, where internet access and tech skills may hinder effective use of e-wallets.

Utilizing the Increased Limit for Investments

The increased GCASH limit of ₱500,000 presents unique investment opportunities. Users can leverage GCASH’s investment features, especially GInvest, for simple market entry.

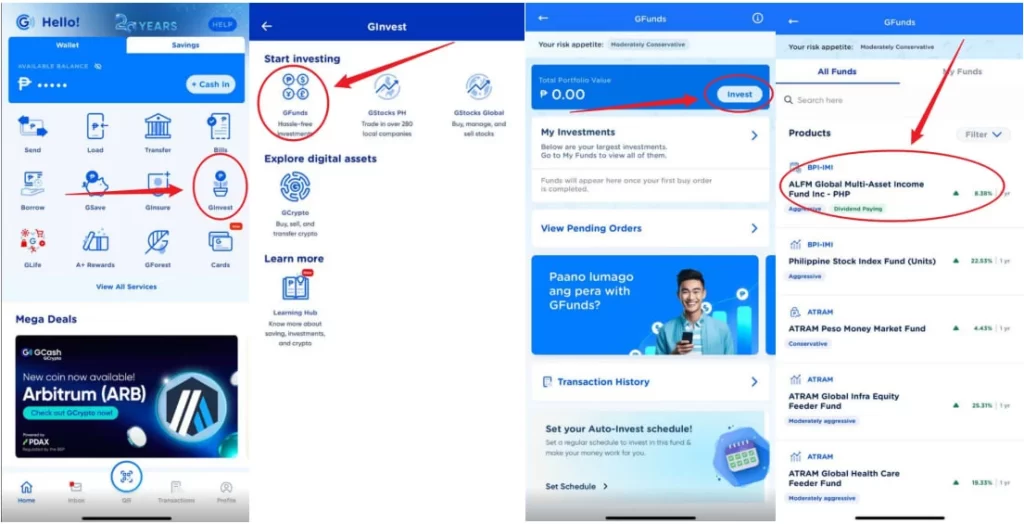

Exploring GInvest in GCASH

GInvest within the app allows easy investment in mutual funds, even for beginners.

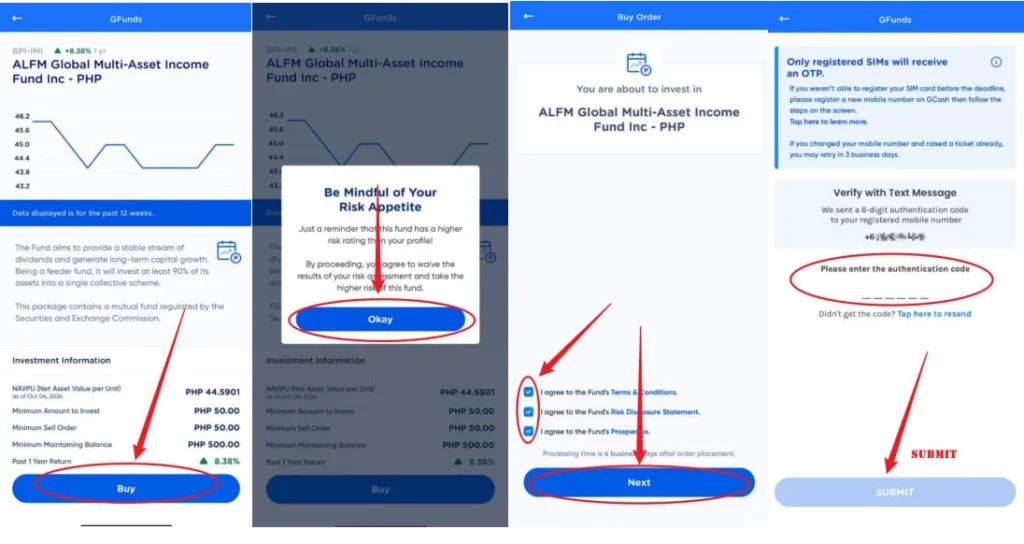

To start, users should open the app, select GInvest, and choose from various mutual funds for investment.

Selecting Your Fund

It’s important to consider financial goals, risk tolerance, and investment horizon when picking a fund. Each mutual fund has different attributes that impact investment decisions.

The Power of Small Investments

GInvest allows small initial investments, but users can now invest more due to the increased limit, enhancing their wealth-building potential.

Maximizing Returns While Managing Risks

Investing poses risks; managing them through diversification across asset classes is essential. Regular performance reviews and adapting strategies based on market changes are also crucial.

Building an Investing Habit

Regular investing is key to wealth accumulation. The new limit encourages long-term thinking, allowing users to benefit from compounding returns.

Leveraging Linked Accounts for Easy Access

GCASH also lets users link bank accounts for managing larger sums resulting from the increased limit.

Linking Bank Accounts

To link a bank account, users visit the “Profile” section and select “My Linked Accounts,” enabling quick fund transfers between GCASH and their bank.

This feature balances liquidity for daily needs while enabling substantial investments as opportunities arise.

Convenience and Accessibility

Linked accounts streamline GCASH usage, enabling quick funding for immediate transactions. This fosters an active engagement with finances.

Staying Informed About Financial Trends

Users should stay updated on financial trends to maximize benefits. Engaging with financial news and community insights aids informed decision-making.

Conclusion

In summary, the GCASH monthly limit has risen to ₱500,000, signifying a new phase in digital payments and investment opportunities for consumers. Adapting to these enhancements enables users to shape their financial futures through informed choices.

By continuously learning and strategically investing, people can leverage the increased limits to achieve greater financial empowerment.

John Flores - Author at PH444

John Flores - Author at PH444, is recognized as a key voice in online gaming and gambling. With extensive experience in casino games and interactions within the industry, his insights have reshaped how both enthusiasts and casual gamblers view online gambling. John covers topics from blackjack and poker strategies to the nuances of state gambling laws, offering readers valuable and engaging information

John Flores - Author at PH444

John Flores - Author at PH444, is recognized as a key voice in online gaming and gambling. With extensive experience in casino games and interactions within the industry, his insights have reshaped how both enthusiasts and casual gamblers view online gambling. John covers topics from blackjack and poker strategies to the nuances of state gambling laws, offering readers valuable and engaging information